federal estate tax exemption 2022

Since 2018 federal tax assessment on estates above 117 million indexed for inflation every year will default back to pre-2018 exemption levels on the first day of 2026. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

New Estate And Gift Tax Laws For 2022 Youtube

As of early 2022 the exemption amount is 1206 million per person.

. The state level estate tax exclusion is lower than the federal exclusion so you could be exposed to the Illinois tax even if you are federally exempt. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples. As of January 1 2022 that will be cut in half.

For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021. The federal estate tax limit will rise from 117 million in 2021 to 1206 million in 2022. Provided that the total taxable value of ones estate comes in under that level it will not be subject to tax.

Trusts and Estate Tax Rates of 2022. 24 rows on november 10 2021 the irs announced that the 2022 transfer tax exemption amount is. For a married couple that comes to a combined exemption of 2412 million.

Each spouse gets an exemption so married couples can pass 2412. In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax.

Employers engaged in a trade or business who pay compensation. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

The federal estate tax limit will rise from 117 million in 2021 to 1206 million in 2022. 12 rows For 2022 the personal federal estate tax exemption amount is 1206 million it was 117. 12 rows For 2022 the personal federal estate tax exemption amount is 1206 million it was 117.

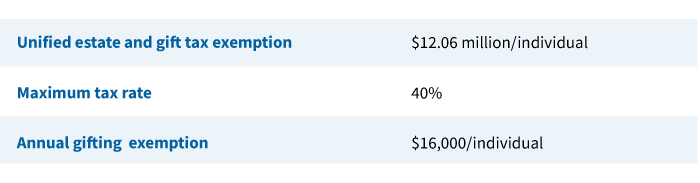

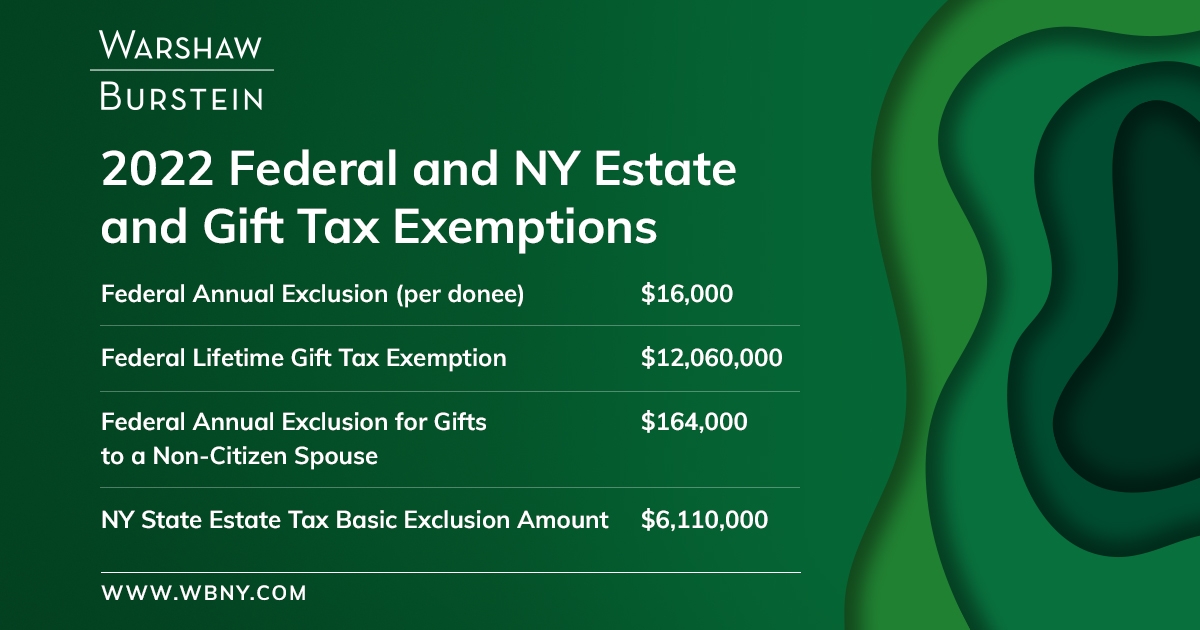

Employers Quarterly Federal Tax Return Form W-2. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. On november 10 2021 the irs announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The tax rate applicable to transfers above the exemption is currently 40. However President Trumps increase was designed to roll back in 2026 so in 2026 the exemption is very likely to roll back to about 7 million per person.

Estate Tax Exemption goes up for 2022 For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. At death a surviving spouses estate will owe estate taxes on the net value that exceeds the. The tax starts at 18 on your first taxable 10000 and climbs to 40 on taxable assets over 1 million.

For married couples the exclusion is now 24120000 million. Your first 1206 million passes tax-free called your federal estate tax exemption. The state does however provide an.

Get information on how the estate tax may apply to your taxable estate at your death. The current federal estate tax exemption amount is 11700000 per person. The federal estate tax exemption provides that an estate with a value below the exemption amount can be passed on tax-free.

In Maryland state estate tax limits will stay at 5 million. The 2022 exemption is 1206 million up from 117 million in 2021. Put simply this will only affect you if the total value of your estate exceeds the tax exemption amount.

Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. The federal gift tax limit will jump from 15000 in 2021 in effect since 2018 to 16000 in 2022. Illinois has a graduated rate that starts at 8 percent and it maxes out at 16 percent.

Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers. Illinois Estate Tax. 11700000 in 2021 and 12060000 in 2022.

The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. 2022 Annual Adjustments for Tax Provisions. Threshold for top federal income tax bracket 37 same as 2021 and the 38 tax on net investment income for estates and trusts over 13450.

Legislation currently pending in Congress could change that limit if it becomes law. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Lower Estate Tax Exemption.

Up from 117 million for 2021 the 2022 exemption amount will be 1206 million. In 2022 the state-level estate tax exclusion in our state is 4 million. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

Since 2018 federal tax assessment on estates above 117 million indexed for inflation every year will default back to pre-2018 exemption levels on the first day of 2026. The exemption for gifts and property is unified which means that it includes both taxable life gifts of an individual and taxable property in the event of death. The IRS recently announced inflation adjustments for the 2022 tax year with Estate Tax rates and Trust tax.

Any amount above is taxed at a hefty 40. Federal lawmakers set an estate tax exemption threshold annually. So how does this affect you.

Ad From Fisher Investments 40 years managing money and helping thousands of families. The first 1206 million of your estate is therefore exempt from taxation. 8 rows there are seven federal income tax rates in 2022.

Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. Up from 159000 in 2021. The federal gift tax limit will jump from 15000 in 2021 in effect since 2018 to.

You can find all the details on tax rates in the Revenue Procedure 2021-45. For couples the exclusion is now 2412 million. The estate tax is a tax on your accumulated wealth assessed by the federal government when you die.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Annual exclusion for gifts to noncitizen spouses 164000. The federal estate tax law and the generations skipping tax GST exemptions are complex and ever-changing and you may need to update your estate plan annually to adapt.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. 1 You can give up to those amounts over your lifetime without paying federal income tax. Up from 13050 in 2021.

The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. To stay updated with federal estate tax laws gifts and generation-skipping tax GST exemptions an annual review and revision of your estate plan may be necessary. New Yorks estate tax exemption threshold for 2022 is 611 million the state does not offer the benefit of portability.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

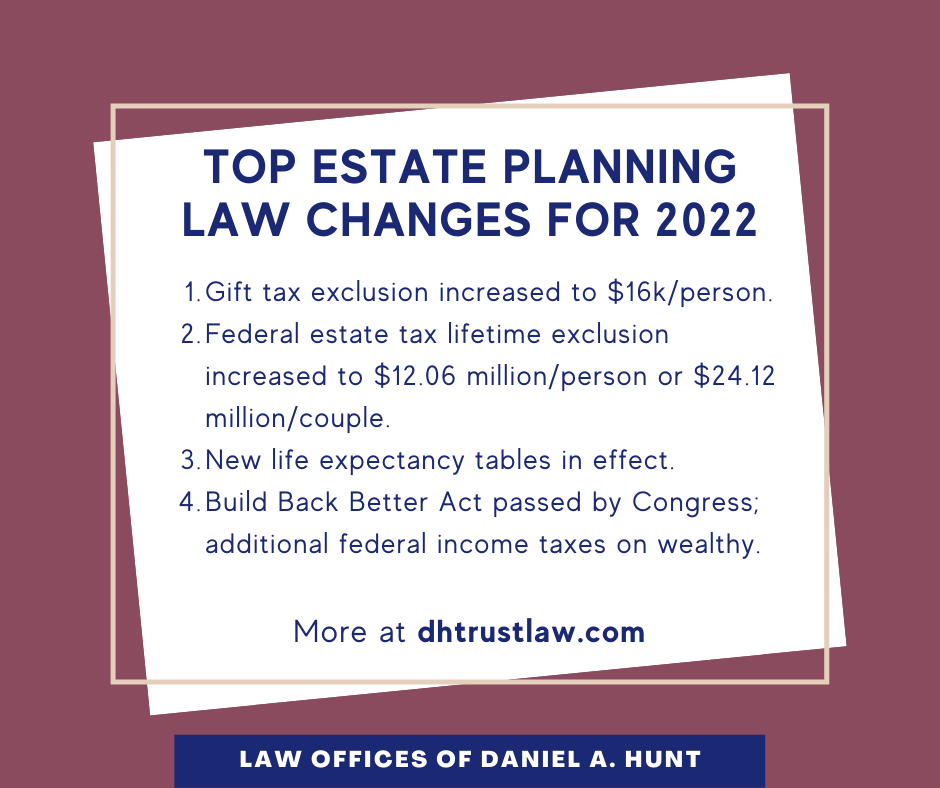

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Four Estate Planning Ideas For 2022 Putnam Wealth Management

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Historical Estate Tax Exemption Amounts And Tax Rates 2022

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

Accounting For S Corp Upcounsel 2019 Accounting Capital Account Tax Money

What Is A Homestead Exemption And How Does It Work Lendingtree

10 Ways To Be Tax Exempt Howstuffworks

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Warshaw Burstein Llp 2022 Trust And Estates Updates

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition